- Home

- Views On News

- Feb 13, 2024 - Top 5 Stocks that Mutual Fund Managers are Buying Aggressively

Top 5 Stocks that Mutual Fund Managers are Buying Aggressively

Mutual fund managers' equity buying remained elevated for the fifth consecutive month in December 2023, taking the net equity purchase past Rs 1.7 trillion in calendar year 2023.

Fund managers bought equities worth Rs 230 billion (bn) until 28 December compared to Rs 180 bn in November 2023, data from the Securities and Exchange Board of India (Sebi) showed.

With inflows into equity MF schemes remaining positive for the past 34 months, domestic MFs have emerged as a pillar of support for the stock market.

In this article, we look at the top five stocks that have seen an increase in mutual fund holdings in the December 2023 quarter.

These stocks are filtered using Equitymaster's stock screener.

#1 Computer Age Management Services (CAMS)

Leading the list is Computer Age Management Services (CAMS).

The company is India's largest registrar and transfer agent of mutual funds, with an aggregate market share of approximately 70% based on mutual fund average assets under management.

The variety of services provided by CAMS plays an important role in developing and maintaining its clients' market perception.

A substantial portion of its revenue, approximately 90%, is generated from its mutual fund operations and the remaining 10% is sourced from diverse non-MF ventures, including insurance repository, Camspay, account aggregation, and more.

The latest shareholding pattern for CAMS reveals a notable increase in mutual fund holding stake, rising from 3.8% in the September 2023 quarter to 11.3% in December 2023.

This can be attributed to the company's strong growth target.

Computer Age Management Services (CAMS) is targeting revenue growth of 14-15% in the current financial year and a profit growth of around 15-16%.

The Chennai-based company aims to sustain its EBITDA (earnings before interest, tax, depreciation and amortisation) margin at around 43-44% for the year.

Further, the company plans to enhance margins by 0.5-1% annually. CAMS has projected a 40% margin in the non-mutual fund segment within the next 2-3 years.

To know more, check out CAMS company fact sheet and quarterly results.

#2 Nazara Technologies

Second on the list is Nazara Technologies.

When it comes to online gaming, Nazara has set a benchmark with its renowned IPs. The company owns several IPs, including Kiddopia, Animal Jam, and the World Cricket Championship.

It offers interactive gaming, e-sports, ad tech, and gamified early learning for users across India, Africa, and North America.

E-sports, which is electronic sports viewership, has outpaced major sports leagues. With increased smartphone and data penetration, the gaming megatrend in India is just getting started.

For the December 2023 quarter, mutual funds have increased their stake in the company to 7.2%, up 6.9% from 14.1% in the September 2023 quarter.

The company, on 20 December 2023, entered into partnerships with four distinguished Indian game studios, in line with promoting the 'Make in India' vision in the gaming industry. This initiative is part of the company's new publishing division launched recently.

As part of the partnerships, Nazara Technologies will publish five innovative games with unique gaming experiences and robust support to Indian game developers.

The publishing division of the diversified gaming and sports media firm will also offer overall support besides financial investment, including mentorship, user acquisition, and live operations expertise.

Coming to its recent developments, the company reported a 1.8% YoY rise in revenue at Rs 3.2 bn for the quarter ended December 2023, and net profit for the quarter came in at Rs 290 million, up 45% YoY.

Going forward, with substantial funds allocated for publishing, Nazara aims to publish 20 games within the next 12 to 18 months, investing between Rs 10 m to Rs 30 m per game.

For more details, see the Nazara Technologies company fact sheet and quarterly results.

#3 TeamLease Services

Third on the list is TeamLease Service.

The company offers temporary staffing, permanent recruitment, payroll process outsourcing, regulatory compliances, assessment, and corporate training services.

According to the December 2023 shareholding pattern, mutual funds have increased their stake in the company to 33.1%, up 5.2% from 27.9% in the preceding September 2023 quarter.

Note that the company's operating margins have improved steadily despite sluggish demand in specialised staffing.

Looking ahead, TeamLease Services plans to intensify its focus on sectors such as artificial intelligence (AI), healthcare, and manufacturing for staffing and recruiting services.

For more details, see the Teamlease Services company fact sheet and quarterly results.

#4 Petronet LNG

Fourth on the list is Petronet LNG.

The company is a government-backed behemoth that stands at the crossroads of India's burgeoning gas aspirations.

Petronet LNG is dedicated to the development of facilities for the import, storage, and regasification of Liquefied Natural Gas (LNG).

It imports roughly 45% of India's LNG, regasifies it at its 11 terminals across the country, and then channels it through a vast network of pipelines to fuel power plants, industries, and households.

According to the December 2023 shareholding pattern, mutual funds have increased their stake in the company to 9.9%, up 5.1% from 4.8% in the preceding September 2023 quarter.

Petronet boasts the largest LNG import and regasification infrastructure in India, giving it a dominant market position and operational efficiency.

The company is actively diversifying its operations beyond LNG imports, venturing into city gas distribution and renewable energy like bio-LNG. This opens new revenue streams and reduces dependence on volatile LNG prices.

Its foray into bio-LNG aligns with India's green energy push, attracting ESG-conscious investors and opening new growth avenues.

After years of strategic debt management, Petronet LNG achieved debt-free status in September 2023, boosting its financial flexibility and creditworthiness.

In recent developments, Petronet LNG (PLL) and QatarEnergy (QE) recently announced the extension of their longstanding contract by 20 years at India Energy Week in Goa. This marks the largest-ever LNG contract extension.

Going forward, the company aims to boost its capabilities by investing Rs 400 bn.

The company's expansion plans include investing Rs 126.9 bn in a propane dehydrogenation plant for converting imported feedstock into propylene. Additionally, Petronet intends to establish an LNG import facility in Gopalpur, Odisha, costing Rs 23 bn.

For more details, see the Petronet LNG company fact sheet and quarterly results.

#5 Fusion Micro Finance

Last on the list is Fusion Micro Finance.

Fusion Micro Finance is engaged in microfinance lending activities, providing financial services to poor women in India as Joint Liability Groups (JLGs). The company provides small value collateral-free loans. Apart from microfinance lending, the company also has lending to MSME enterprises.

During the December 2023 quarter, mutual funds significantly increased their stake in the company, elevating ownership from 10.7% in September 2023 to 15.8%.

The company has strong growth levers in place. In the September 2023 quarter, the company reported a 26.3% YoY rise in total income to Rs 5.7 bn. The net profit for the quarter came in at Rs 1.3 bn, up 32% YoY.

Fusion's stellar performance also comes against the backdrop of low asset quality stress in the microfinance sector.

Apart from this, the company is currently seeing a monthly disbursement run rate of around Rs 8.5 bn.

Going forward, the company plans to become a trusted financial service provider in rural India.

For more details, see the Fusion Micro company fact sheet and quarterly results.

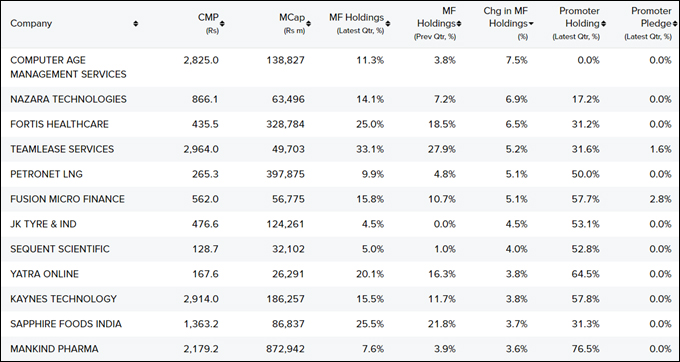

Snapshot of Stocks that Mutual Funds are Buying

Here's a table showing the above stocks on important parameters -

Please note, these parameters can be changed according to a user's instructions.

To Conclude

Investors may find it tempting to consider buying stocks when fund managers are actively purchasing the same company's shares.

Firstly, mutual funds are managed by seasoned professionals who bring a wealth of expertise to stock selection, conducting thorough research and analysis.

Additionally, by investing in stocks favoured by mutual funds, investors can achieve diversification across various sectors without the need for extensive individual analysis. The considerable size of mutual funds as institutional investors instils market confidence, with their buying decisions often viewed as a positive signal.

Nevertheless, it's crucial for investors to conduct independent research and consider their financial goals and risk tolerance before aligning their portfolio with mutual fund activity.

Since you're interested in what mutual funds are buying and selling, check out Equitymaster's stock screener which has a separate section for tracking institutional activity.

Here are some popular screens:

- Stocks Recently Bought by Mutual Funds in India

- Stocks Recently Sold by Mutual Funds in India

- Stocks Recently Bought by FIIs in India

- Stocks Recently Sold by FIIs in India

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 5 Stocks that Mutual Fund Managers are Buying Aggressively". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!